- The eye-opening truth about inequality

- Why does the UK need a wealth tax?

- Welcome to The Fair Pour

Tax the rich - Why does the UK need a wealth tax?

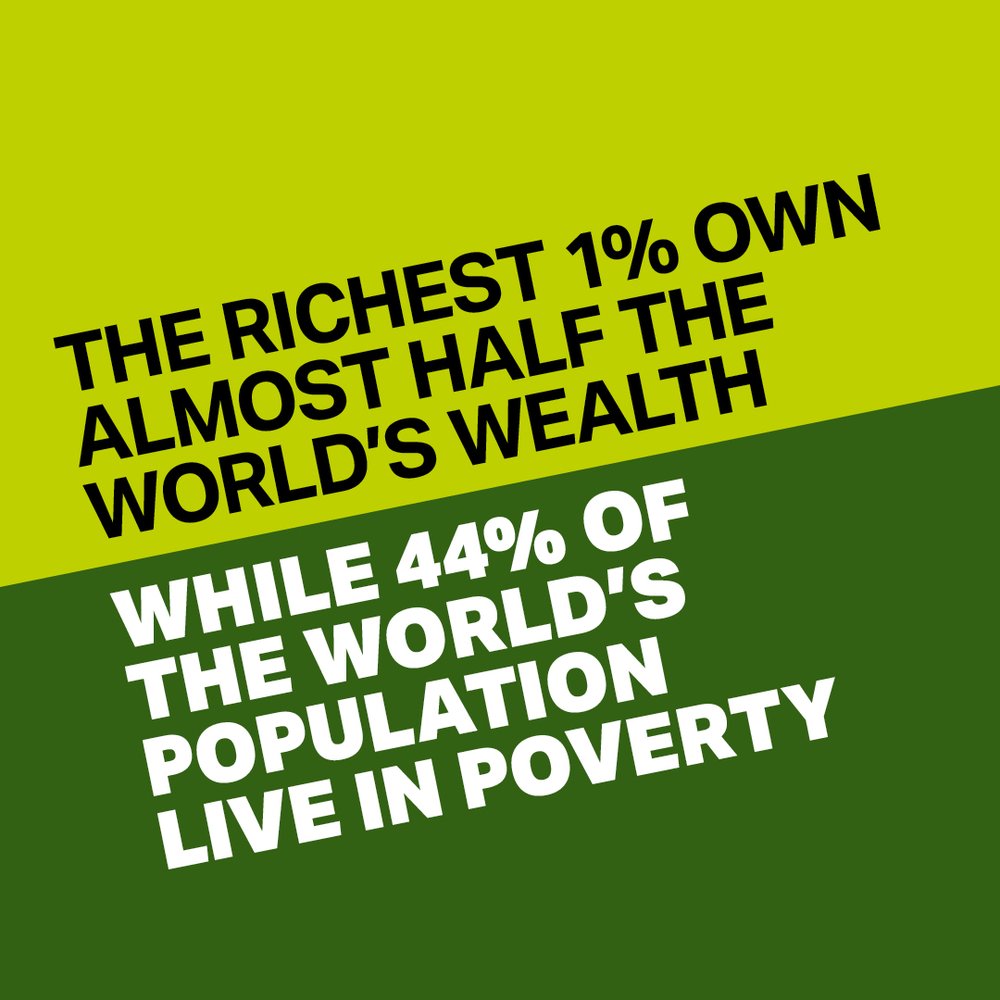

We live in a world where there is enough wealth to tackle the biggest global challenges like poverty and the climate crisis, if only the wealth was distributed fairly. Taxing the super-rich is one way to start to address this. We urgently need to move away from an economy that is rooted in inequality and exploitation, to one that puts the wellbeing of people and planet first.

What is a wealth tax?

How would a wealth tax work in the UK?

Is Oxfam calling for a UK wealth tax?

Why do we need a wealth tax in the UK?

Demand a wealth tax now

Tackling inequality starts with making those at the top pay their fair share. A wealth tax is just an example of more taxes we need. We should be taxing the super-rich to tackle inequality and fight the climate crisis. Chancellor Rachel Reeves: Tax wealth now

Wealth inequality in the UK

Inequality and the cost-of-living crisis

Do the rich really pay their fair share of taxes?